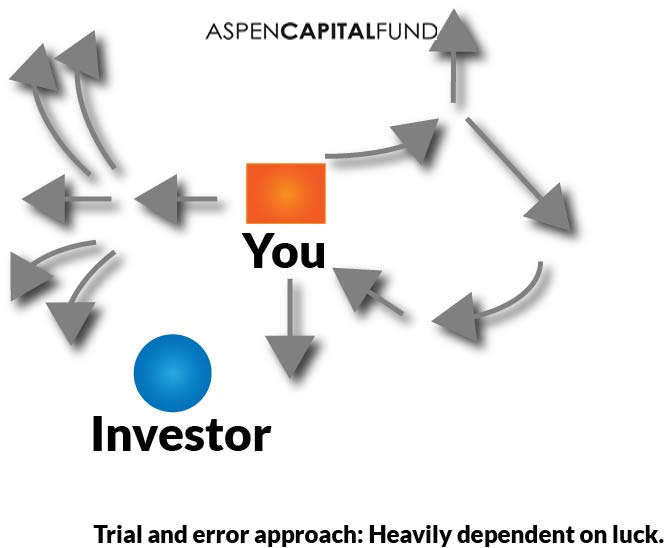

How to raise capital from private investors without just a lot of trial and error for several years.

You have something excellent to offer the marketplace and you are ready to raise capital. You are planning to raise capital the old-fashioned way, starting with friends and family and then cold-calling potential investors and slowly networking in local circles to form new relationships. Your plan is trial and error approach that depends heavily on luck. You think you can succeed because it’s a numbers game, but you’re WRONG.

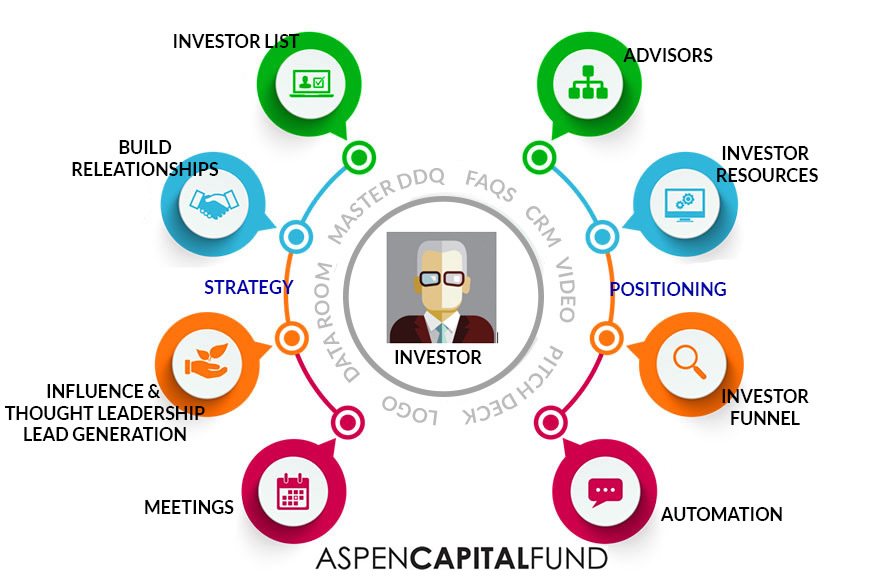

When raising capital there’s no reward for second place. To win you need a system for positioning yourself in the flow of investors using best practices, processes, and investor strategies. You require a plan for investor lead generation. You need what is called a capital raise strategy.

The difficulty isn’t finding capital, it’s the lack of knowledge on the process of how to successfully get the capital. Gathering this knowledge can take a tremendous amount of time and trial and error.

We have taken what we have learned at Aspen Capital Fund through formal education, work experience in the venture capital industry, and hundreds of meetings and contacts – and put it into the Capital Raise Strategy workbook.

In the Capital Raise Strategy workbook, you will learn:

- How to avoid trial and error and expensive mistakes. Why the brute force mentality doesn’t drive much traction or success.

- Where to find investors and build your own network of investors to tap into. You will start with a list of all types of investors, you will create an ideal investor profile and target local investors.

- How to build a strategy to influence and attract investors through a defined process. Why a strategic advisor brings successful capital, and how to attract investors from influence, direct response, and authority-driven inbound lead generation and thought leadership-based marketing strategies.

- How to position yourself in the flow of qualified investors through long term planning, using CRM, automation and investor relations.

Aspen Capital Fund is uniquely positioned to help with customized resources to build a compelling and complete capital raise strategy.

Learn what insiders know: our process teaches you how to visualize, architect and build a process with the most important variables of:

Building a team.

Building your own successful capital raise platform.

Attracting investors.

We offer our clients a database of investors that include:

- Global Family Offices –

- Private Equity Firms by Type

- United States Investment Banking & Corporate Finance Contacts

- Insurance Companies

- United States Venture Capital Contacts

- Registered Investment Advisors, Wealth Management Firms

- West Coast Registered Investment Advisors

- Institutional Investors – Pension Funds, Consultants, Insurance Companies etc,

- Endowments / Foundations

- Corporate & Government Pension Funds

- Mutual Funds

- Investment Consultants

- Fund of Funds (Private Equity)

- Foundations / Tax Exempt Investors

- Midwest Registered Investment Advisors, Wealth Management Firms

We teach our clients the importance of using a CRM and integrating your timeline and execution plan.

We help our clients to strategically influence investors and create attraction using things like social proof, authority building and content.